To find out more about Davy Horizons

We’re ready to help you plan for a sustainable future

08th April, 2024

In 2024 many elements will influence corporate priorities on climate change as well as wider sustainability goals for businesses and their capital providers. For businesses based in the EU and UK a tsunami of legislation will dictate the priorities across Environmental, Social and Governance (ESG) issues with climate change and alignment to a 1.5oC future the goal. At the global level, slow progress on climate change policy, as evidenced by COP28, major elections in over 40 countries including the USA, and geopolitical instabilities will make for a turbulent year. However, the direction of travel towards a green economy is clear.

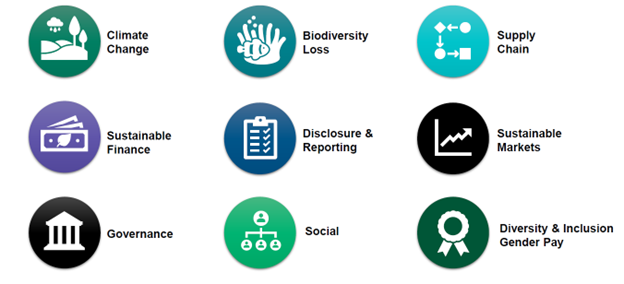

Sustainability focus areas for corporates and capital providers across ESG

EU Mandatory Sustainability Reporting from 2024 - The Corporate Sustainability Reporting Directive (CSRD) phases in from 2024 bringing a “game changer” level of annual reporting obligations on ESG. This applies to corporates headquartered, or with significant operations in the EU. Starting with large corporates it will expand to bring in SMEs by 2028 and is expected to bring circa 50,000 businesses into mandatory non-financial reporting. On climate change alone CSRD mandates Greenhouse Gas (GHG) emission reduction targets that are science based and 1.5oC aligned. It requires Climate Transition Plans and investment to achieve targets, with net zero emissions by 2050 the ultimate goal.

Global Sustainability Reporting - If the CSRD does not impact a corporate, the International Financial Reporting Standards (IFRS) Climate and Sustainability Disclosure Standards1 are also now phasing in. While less onerous than CSRD, they will drive accountability on climate change and wider ESG topics across global markets. The bottom line is sustainability reporting is becoming business as usual.

Decarbonisation across the value chain (called Scope 3) in the spotlight - CSRD mandates inclusion of Scope 3 emissions in the value chain. This is actually where over 70% of most corporate emissions occur so makes sense for progressing meaningful carbon reductions. This makes supplier engagement, green procurement and the use of internal carbon pricing key requirements to incentivise action.

Reporting “Carbon Leakage” - To prevent so-called “Carbon Leakage” from manufacturing outside the EU, the EU Carbon Border Adjustment Mechanism (CBAM) legislation2 starts reporting from January 2024. This mandates corporates to track and report GHG emissions from all EU imports of GHG intensive products including cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

Sustainable markets growth – The Sustainable Finance Disclosure Regulation (SFDR), which has been live since 2021 continues to regulate shareholder ESG requirements and drive sustainable investment across EU markets. Funds promoting environmental or social characteristics reached the new high of over €5 trillion in AUM in 20233. This is expected to continue into 2024 as sustainable markets continue to grow.

Continuing investment in green technologies and sustainable economic activities - The EU Taxonomy regulation which defines sustainable market activities for economic sectors will continue to shape plc investment and mergers and acquisitions as the EU in particular, transitions to a net zero economy. For plcs, disclosures showing increasing Taxonomy aligned Turnover, CAPEX, OPEX are mandatory in annual reporting.

Bank Pillar 3 disclosures - EU banks must disclose the Paris alignment of their credit portfolios by the end of 2024 at the latest, including Green Asset and Taxonomy Alignment Ratios. The added disclosure requirements may ultimately mean additional focus on green and Taxonomy-aligned lending and bond issuance.

Stopping greenwash from green claims - The Directive on Empowering Consumers for the Green Transition (ECGT)4 agreed in January 2024 aims to support consumers make informed choices on the sustainability credentials of products they buy. Product producers will only be allowed to mark a product as “green” when the entire product is truly greener than conventional ones and certified to a trustworthy, third-party schemes.

Responsible Sourcing in value chains – the growing focus on value chains is also driven by incoming requirements for integrating due diligence and traceability on environmental protection, human rights and working conditions across value chains. CSRD mandates accountability and reporting extending to workers in a corporation's value chain. The incoming Corporate Sustainability Due Diligence Directive (CSDD) expected to go live in 2026 will build on this.

ESG Ratings legislation - In 2024, we expect to see the introduction of ESG Ratings legislation to ensure a consistent, meaningful approach is used across ESG rating activities and providers. This and CSRD aligned sustainability reporting are expected to change the role of ESG ratings, which have been a mainstay in informing investors to date on corporate ESG performance.

With CSRD going live in 2024 and corporates reporting more consistent and better quality ESG data, Climate Transition Plans and Taxonomy-aligned performance, financial stakeholders can more easily assess the upcoming risks and opportunities brought about by climate change in their lending/asset/insurance portfolios. This will continue to drive pricing differentials between those corporates aligned to the transition and those that are not.

Davy Horizons sustainability advisors work with plcs, large private companies, government bodies, semi-states, and not-for-profits to incorporate sustainability credibly in their organisation and value chains aligned to regulation, industry best practice and customer demand. We provide sustainability consultancy services to businesses across all sectors including on:

Sources

[1] IFRS - Home

[2] Carbon Border Adjustment Mechanism - European Commission (europa.eu)

[3] SFDR_Article_8_and_Article_9_Funds_Q2_2023_in_Review_080823.pdf (contentstack.io)

[4] Products - labelling rules and requirements - European Commission (europa.eu)

We’re ready to help you plan for a sustainable future