See the full potential

In inflationary times, doing nothing could be your riskiest move.

08th March, 2024

While equity and bond market volatility could persist in the short run, sentiment has improved measurably in 2024. Indeed, with the cooling of inflationary pressure across the US & global economies, we expect to see a continued pause in central bank monetary policy tightening. This would be a positive for equity and bond markets over time.

In inflationary times, doing nothing could be your riskiest move. We offer a broad range of investment and liquidity solutions.

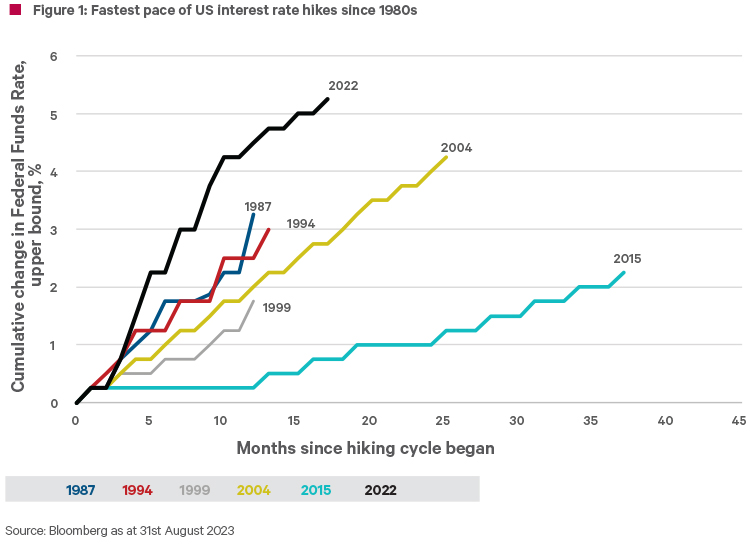

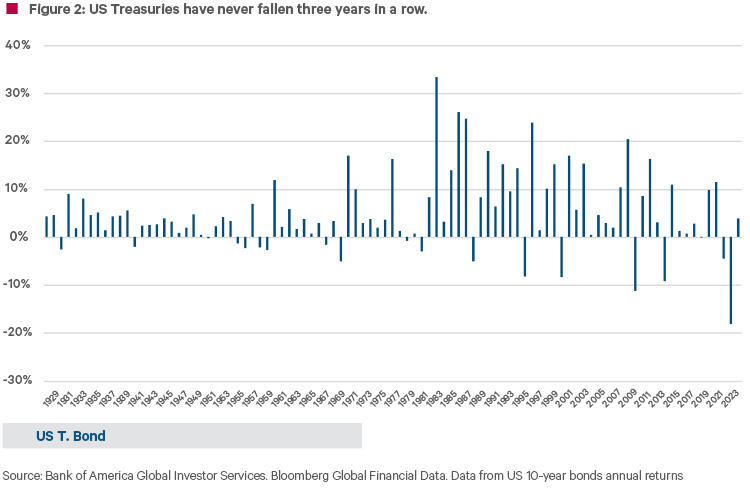

After the COVID-19 pandemic related economic shutdowns, there was a plethora of economic demand and supply-side imbalances. These imbalances caused strong inflationary impulses globally. The central bank reaction function has been to increase interest rates in an aggressive trajectory. Furthermore, most Central Banks that undertook Quantitative Easing (QE) have also started the process of reducing their balance sheets, which has further tightened monetary policy & liquidity. The sharp increase in yields from such low levels produced losses across 2021 & 2022 in bond markets. Losses across US Treasuries for 3 years in a row were narrowly avoided, which would have been historically unprecedented.

Bond yields have been on a steady climb for the last three years. After the worst bond market performance on reliable record in 2022, market consensus was that the higher interest rates would lead to an economic recession. Recessionary projections have taken longer to manifest than most predicted, particularly in the United States, with many now questioning whether a recession can now be averted.

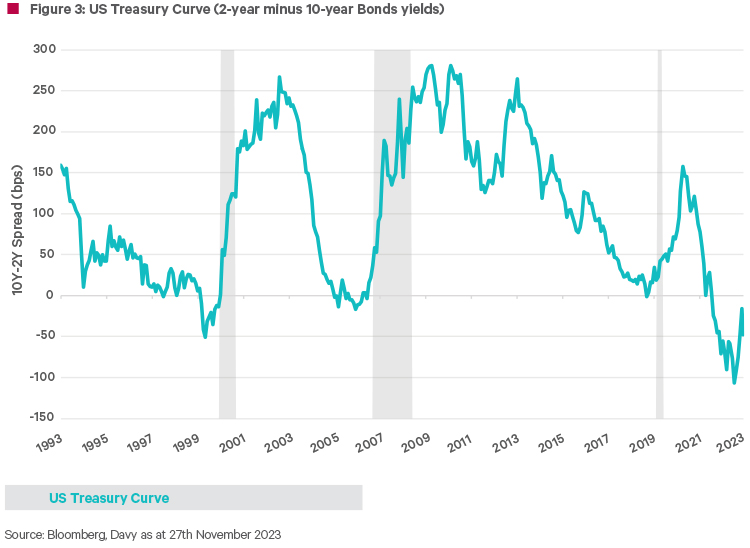

The US Treasury yield curve was upward sloping in December 2020 (i.e., investors are compensated with higher yields, the longer the maturity of the bonds). As interest rates were increased, pushing bond yields higher, the curve inverted in November 2022 (this occurs when yields on short-term bonds such as 2-year bonds are greater than longer-term bonds such as 10-year bonds). This is a strong market indicator that an economic recession in the USA is imminent (which historically starts on average within 13 months of the curve inverting).

The yield curve has remained inverted which signals market expectations that the US Federal Reserve and other central banks would be able to start cutting interest rates as soon as any recession begins. This is what kept long-term bond yields (10-year or longer) from rising to a level that would imperil the economy.

However, during the summer of 2023, market consensus shifted from a USA recession to an economic soft landing in the USA. This was the impulse to see bond yields take another leg higher, which has flattened the US Treasury yield curve. The chart above illustrates how the US Treasury curve has shifted from being heavily inverted on 31st July, and ‘flattening’ by 31st October. 2-year bond yields increased only 0.2%, whereas the 10-year bond yield increased by 0.9%.

The rise in yields cannot be explained by higher-than-expected terminal interest rates, which is illustrated by the relatively limited move higher in yields in 2-years bonds. Furthermore, yields going higher are not driven by higher inflation expectations, as longer-run expectations are falling.

Consensus surrounding the soft-landing of the US economy is premised on the US economy not needing a near-zero cost of capital going forward. This has given rise to the concept of ‘higher for longer’. In normal market conditions, yields for longer-dated bonds are higher than shorter-dated ones, which is logical. Longer-dated bonds, if held to maturity, take longer for the initial investment to be paid back, involve greater risk and should therefore recompense investors with greater yields.

The flatness of yield curves today means by and large there is marginal additional yield in longer dated bonds, so why take the additional capital risk when you can get paid the same yield in short-dated bonds?

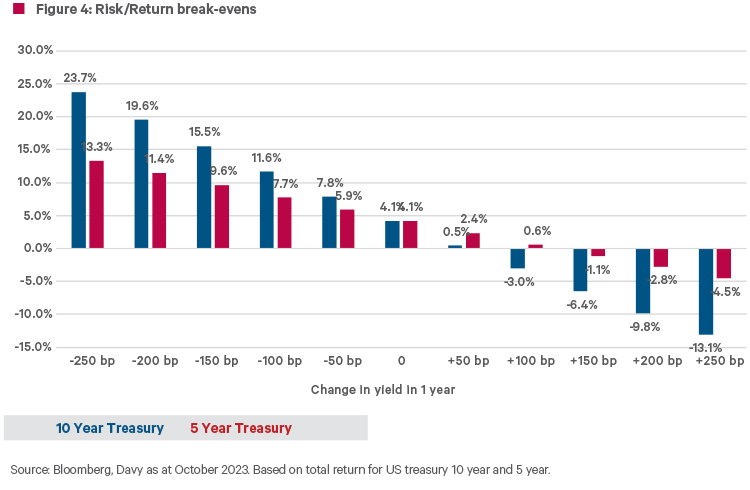

1. Risk/Reward attractive versus cash yields

The risk/return for government bonds has improved significantly. Investors can earn as much income in 1-year bonds as in 5- year bonds, which may seem attractive at first glance. However, the cash yields mask the reinvestment risk (will yields be lower in 1 year?) and forego the potential for capital gains should yields fall. Higher starting yields for the first time in years now provide a cushion for a scenario where yields rise further from here – meaning that any downside return from here is likely to be quite limited. For example, with the US 5-Year Treasury yield at 4.12%, yields would need to move higher than 5.2% before making a loss over a one-year investment horizon.

2. Rate hike cycle and a forward-looking market

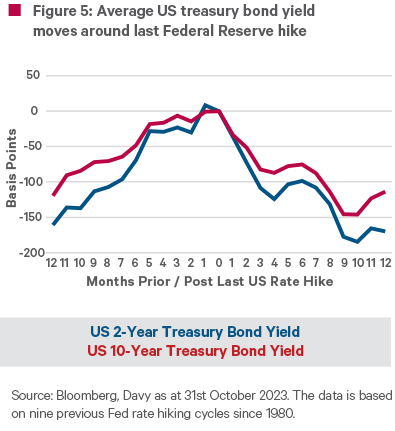

Although we do not know for certain central bank interest rate paths, it is our view that the rate hikes for this cycle are now complete in the US, Eurozone and the UK. Historically US 10-year US Treasury yields have tended to peak within a couple of months either side of the last rate hike of the cycle. With election cycles in 2024 in the US, EU and the UK, there will be considerable political pressure to see limited further interest rate increases, given the pressure on an already stretched consumer. On average, the US Federal Reserve (Fed) remains on ‘pause’ for seven to eight months after its hiking cycle, before cutting interest rates.

In March 2024, the futures market is pricing the Fed Fund rate to be ~4.5% by December 2024. Bond markets are forward-looking, so following the last interest rate increase in each of the past nine US hiking cycles, on average bond yields moved lower.

3. Return of traditional diversification benefits and risk management

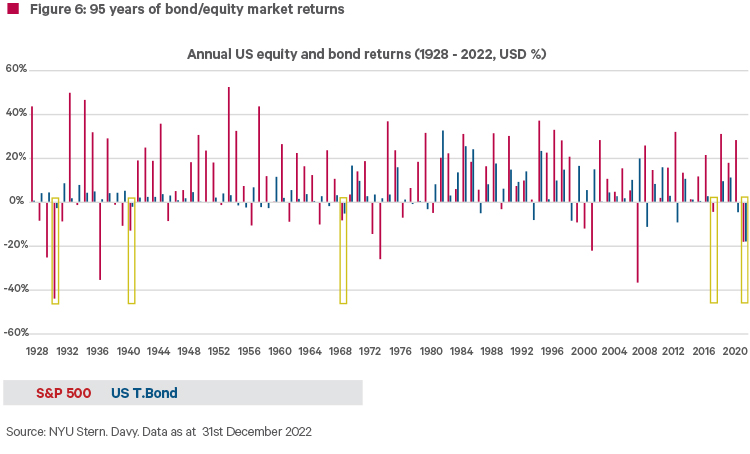

Investors should also consider a holistic risk management approach. Investors could rely on bonds for protection when equities sold off from 2000 onwards as stock–bond correlations were consistently negative. This relationship broke down in 2022, the US Total Bond index lost 13% in 2022 coinciding with a -18.1% decline in the S&P 500. The trailing three-year correlation turned positive for the first time since 2000.

QE has had far reaching consequences for such correlations, many of which remain unknown. As the chart below illustrates, 2022 was only the fifth time in history that bonds and equities were both negative (1931, 1941, 1969, 2018). Following these negative years, average equity and bond returns were 11.3% and 9.4% respectively. Although this bond/equity traditional diversifying relationship has shifted over the last few years, largely due to an increase in inflation volatility, the diversification benefits could return in stressed scenarios, and bond investors are paid handsomely in the interim.

We believe that we have seen an end to this iteration of the global central bank interest rate hiking cycle. We believe bonds now offer an attractive risk/reward investment profile, offering strong carry credentials. Furthermore, the current global disinflationary trajectory should alleviate some of the risks of higher interest rates being needed going forward.

Moreover, the historically defensive characteristics of bonds, which have been missing for three years, are likely to return. Holistically, this could exhibit improved portfolio diversification and risk mitigation in the coming quarters. This would be a positive for both equity and bond markets over time.

In inflationary times, doing nothing could be your riskiest move.

Warning: Past performance is not a reliable guide to future performance. The value of your investment may go down as well as up. These products may be affected by changes in currency exchange rates.

Warning: Forecasts are not a reliable indicator of future performance.