Outlook 2017: New World Order

This article is from our Global Outlook for 2017 which takes a look back at key political and economic milestones for 2016.

01st January, 2017

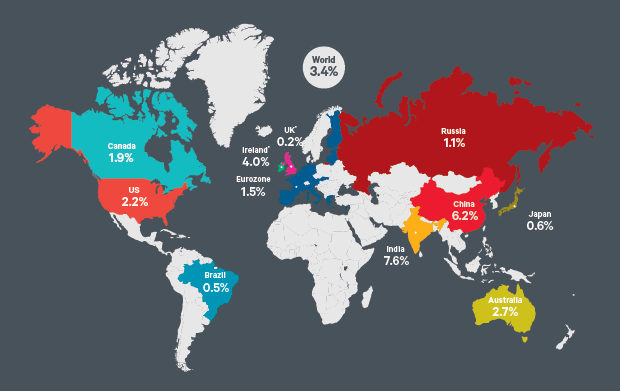

Despite a number of potentially destabilising political events, the pace of global economic expansion picked up in the second half of 2016. According to the International Monetary Fund (IMF), the global economy expanded by 3.1% in 2016 and will grow by 3.4% in 2017.

Of the major developed nations, growth will be driven by the US economy, which is expected to grow 2.2%. The Eurozone is expected to expand at a more modest 1.5% and, although there are concerns about the housing market and the build-up of debt in China, its economy is forecast to grow by over 6%.

% Gross Domestic Product (‘GDP’) growth forecasts for 2017

Source: IMF, World Economic Outlook Database, October 2016

*Davy Forecasts

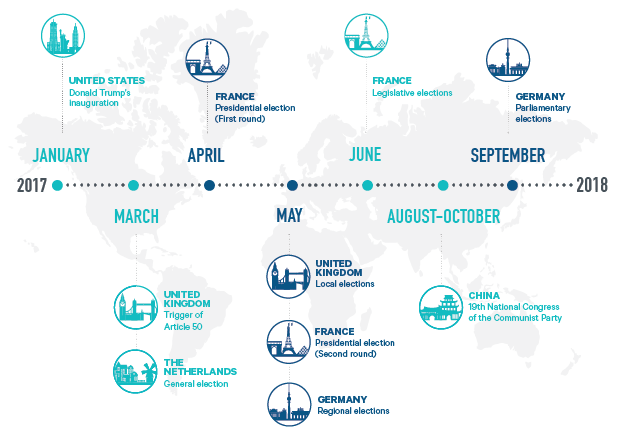

However, we expect 2017 to be challenging politically. Brexit discussions will continue, and there are a number of European elections this year that will test investors' nerves.

Across the globe, voters are sending a clear message to their respective governments that they are not happy with the status quo. Much of this anger can be traced back to the weak recovery in the aftermath of the financial crisis, one of the slowest ever recorded. In particular the squeezed middle, blue-collar workers from Michigan to Sunderland are using their democratic right to demand change.

As unpalatable as his views and opinions may be, Trump’s victory could be a game changer for economic policy. In a return to Reagan-like, Keynesian-style economics, he has promised to cut taxes, reduce regulation, spend big on rebuilding America’s ageing infrastructure and create jobs. This clearly hit a nerve with voters.

Although it is unclear how these policies will be funded, expansionary policies have the potential to extend and prolong the current economic cycle that was at risk of running out of steam. This could prompt a significant change in policy direction for other governments in the coming years to appease their electorate. Governments can currently borrow at record low interest rates and politicians may find the path of least resistance is to loosen the purse strings.

A more worrying trend emerging is the reversal of globalisation and the introduction of protectionist policies. For most of the past 30 years, globalisation was considered a positive force. It facilitated many people in developing nations to exit poverty, but many in the developed world have failed to see the benefits and feel left behind. How closed the global economy becomes in the years ahead remains to be seen. The last period of protectionist policies in the 1930s did little to improve global prosperity and did not end well. This is something that needs to be monitored closely in the years ahead.

A key feature of the economic and investment landscape in 2017 will be diverging monetary policy. Having raised rates just once in 2016, the US Federal Reserve (Fed) is expected to raise rates 2-3 times in 2017. A key difference this year is that we expect inflation to pick up as rising wage pressures and increased oil and commodity prices push prices higher. This is something we have not seen for several years.

In contrast, the European Central Bank (ECB) and the Bank of Japan (BoJ) are expected to keep monetary policy accommodative to help support flagging growth in their respective economies. The ECB has signalled that it may taper its Quantitative Easing (QE) programme at the end of the year.

Europe will enter the political fray in 2017. Like the Italian constitutional referendum, elections in France, Germany and the Netherlands will be viewed as votes on the future of the Eurozone. As much as they can be trusted, the latest opinion polls show Angela Merkel in the lead in Germany, but she is facing a backlash due to her open door policy on migrants. In France, François Fillon has a lead in the polls over right-wing Marie Le Pen, but again we must question the ability of pollsters to predict election outcomes.

Source: Davy

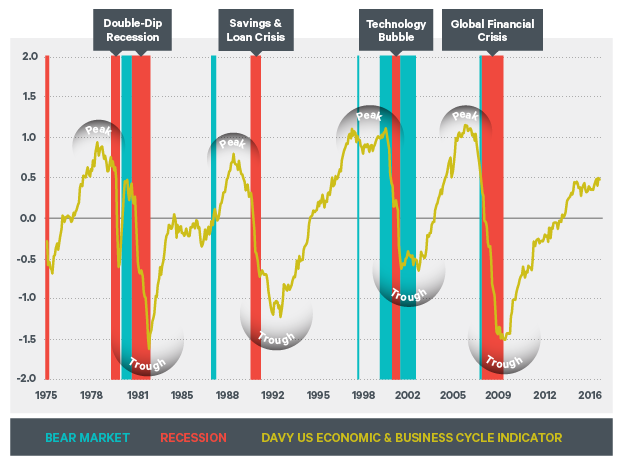

Against this backdrop, we expect a pick-up in global growth in 2017. Figure 3 shows our economic and business cyclical indicator which looks to assess turning points in the business cycle. It suggests that although things have improved considerably since the financial crisis in 2008/9, conditions today are not consistent with those present in the lead up to the last four major recessions. This gives us confidence that in the absence of an exogenous shock, the likelihood of a recession is still relatively low. This also suggests that it is a good time to stay invested, although investors should factor in lower potential returns going forward than they achieved during the early stage of the cycle.

Note: Recessions and Bear Markets defined by the NBER. Recessions overlap Bear Markets for the purpose of this chart.

Source: Bloomberg, Davy and National Bureau of Economic Research (NBER)

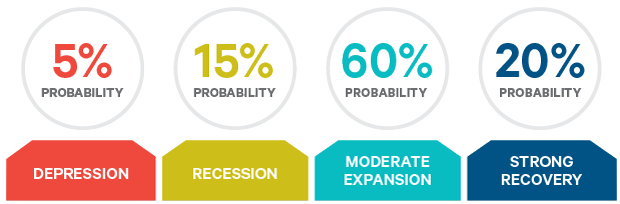

Taking this into consideration, we assign probabilities to different economic scenarios occurring in 2017 (see Figure 4). These range from a depression, which would be a repeat of the 2008 financial crisis (5%), to a more normal recession (15%), to our base case of a modest expansion (60%), to a strong recovery (20%).

This article is from our Global Outlook for 2017 which takes a look back at key political and economic milestones for 2016.

Past performance is not a reliable guide to future performance. The value of investments and of any income derived from them may go down as well as up. You may not get back all of your original investment. Returns on investments may increase or decrease as a result of currency fluctuations.