Download full publication

This article is from our Outlook 2018 edition of MarketWatch.

25th January, 2018

We think it will be another positive year but there are a few caveats. The post financial crisis recovery which started in 2009 is now in its 102nd month. Global equities are higher than their peak before the financial crisis. So the current bull market is one of the longest recorded since the Second World War. Understandably given the length of this rally, there are some concerns.

MarketWatch: How did the market perform last year?

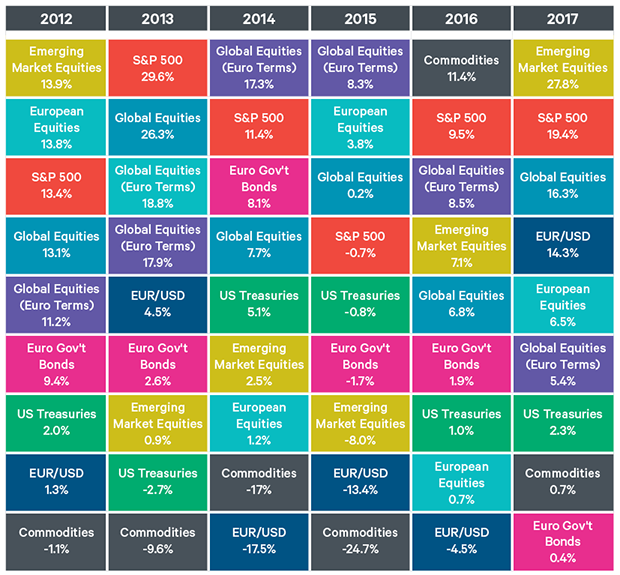

Eoin Corcoran: On the whole it was another good year, albeit returns were lower than previous years. Excluding some sizeable currency movements during the year, global stocks rallied on the back of strong corporate earnings growth and improving economic data. In local currency terms the equity market finished the year up an impressive 19%. However, this does not tell the full story as the falling US dollar played havoc with returns for investors living outside the US. Returns for European investors who had to convert their holdings back into local currency were much lower due to the euro strength. That said, global equities were still up 7.5% in euro terms inclusive of dividends (5.4% excluding dividends). So all in all another good year.

One of the most notable features was the calm market conditions throughout the year. Positive sentiment was not dented by rising tensions with North Korea and the ongoing failure of the Trump administration to realise its policy objectives. This is in stark contrast to recent years when issues such as Brexit sent markets into free fall.

At a regional level emerging markets were the big winners. Having lagged considerably in recent years, nations including India and China enjoyed stellar equity returns. In the developed world, the US outperformed Europe again. The stand out sector was technology which was up 36% in local currency, 19% in euro terms. Also it was good to see active managers regaining some ground as the majority of fund managers outperformed their respective benchmarks in contrast to last year. As has been the case for a number of years, bonds struggled to make headway against a backdrop of low interest rates.

MW: There were some large moves in the currency markets. Who were the winners and losers?

EC: The US dollar was easily the worst performer of the major global currencies. Having started the year with the euro at 1.05 versus the dollar, the dollar fell 14% to finish the year at 1.20. The primary reason was improving economic data in Europe, but it also reflected sizeable dollar gains since 2014. Through a wider lens this weakness was just part of the retracement of the strong dollar move since it traded at $1.40 in 2014. If the European economy continues to improve, we could see a weaker dollar again in 2018. So euro investors should ensure they are not holding too many dollar assets in their portfolios.

MW: What can investors expect in 2018 and beyond?

EC: We think it will be another positive year but there are a few caveats. The post financial crisis recovery which started in 2009 is now in its 102nd month. Global equities are higher than their peak before the financial crisis. So the current bull market is one of the longest recorded since the Second World War. Understandably given the length of this rally, there are some concerns. Our base case is that we think investors can expect positive returns from their portfolios but we expect returns to be lower. This is in keeping with what we have witnessed at similar stages of previous cycles. The later in the cycle we are, the more expectations for economic growth are priced into asset valuations, which bring lower, but still positive returns. Today looks no different.

That said, as we start the year the economic backdrop is good. All of the major economic regions are growing which should support corporate profits and drive prices higher. However, one of the unusual things about markets last year was the relatively benign conditions. There was no sell-off of note in equity markets in 2017. There was plenty of divergence in individual stock returns and the extreme winners and losers helped to minimise the overall volatility. We think investors may have to endure slightly more volatility in their portfolios in 2018.

Source: Bloomberg

MW: How are Davy portfolios positioned as we start the year?

EC : In terms of translating the positive economic backdrop into portfolios, in comparison to our strategic asset allocation benchmark, we remain neutral on equities, we are overweight alternative funds – including property funds - and we are underweight bonds due to the low yields.

Equities have been the only game in town in recent years but after strong performances, valuations look slightly stretched as we start the New Year. European equity markets have lagged the US for a number of years now. However, I think the strong economic momentum in mainland Europe means that our current holdings of companies that are more exposed to the domestic recovery are likely to continue to outperform this year.

In the US we have allocations with managers who are also focused on the domestic economy. We think that they will benefit from continuing economic growth and potentially the tax reforms.

Overall we maintain a preference for fund managers with a bias to purchasing high quality companies across all regions. We think this strategy will serve us well over the long run as higher quality companies tend to outperform the broader market.

The alternative allocations in our portfolios continue to include Irish and pan-European property, which offer attractive yields above 4%. Our managers implementing alternative strategies have helped in recent times from a risk management and return enhancement point of view. Their ability to invest across the full investment landscape and adjust views quickly is an attractive feature.

MW: What about bonds?

EC: Bonds have been the subject of much discussion in the media and we continue to believe that they will play an important part in portfolios as we move later into the economic cycle. Bonds will help to protect against any potential shock. Central banks are starting to withdraw some liquidity which should push bond yields higher and prices lower. Therefore, we remain underweight fixed income, but expect in time that we will look for ways to increase this position as yields move higher.

MW: What do you think is important for investors to consider at this time? EC: When you have had a strong stock market for a number of years, investors can be reluctant to invest as they worry they have missed their chance. The most important thing is that investors understand the risks associated with their investment strategies and decisions. It is impossible to control the market and what returns can be achieved, but it is possible to control the level of risk we are exposed to.

History tells us that at this point in the cycle the potential to make poor investment decisions is greatly increased. Portfolio values have risen and the economy is growing strongly. Investors hear anecdotes about “all the money to be made in x or y” and feel the need to make more concentrated investments to earn that higher return. This is not unusual but what we have learned is that investors tend to focus on the high return element of this equation without a clear consideration of the risks involved.

MW: Should investors take on more risk to generate a higher return?

EC: As the phrase goes, “there is no such thing as a free lunch”. Anything promising a higher level of return must have a higher risk of not performing as expected. Investors must always consider the possibility that an investment may not perform as expected.

Higher risk investments may have a place in an investment strategy, but they should be sized appropriately and investors should diversify across a number of them to reduce risk. We firmly believe that there should be a clear objective associated with every investment decision and this should be aligned with the ultimate requirement for the capital. This can be achieved by engaging in financial planning exercises to understand your asset and liability position. But more importantly such exercises will encourage investors to focus on the financial outcomes that are important which can then determine future decisions on savings, spending and investment.

The message we have for investors is to continue to expect growth. However, this growth may involve increased short-term volatility so it is important to continue to ensure appropriate diversification.

Our advisers construct multi-asset portfolios using a mix of assets such as equities, bonds, hedge funds, commodities and property. These portfolios are carefully designed to ensure the right balance of investments for an individual’s risk and return objectives, and are actively managed to ensure our clients’ wealth grows in a controlled manner.

This article is from our Outlook 2018 edition of MarketWatch.

Warning: Past performance is not a reliable guide to future performance. The value of investments and of any income derived from them may go down as well as up. You may not get back all of your original investment. Returns on investments may increase or decrease as a result of currency fluctuations.

Warning: Forecasts are not a reliable indicator of future results.