Download Davy Lifestyle Solutions

Download a PDF of our brochure outlining how Davy Lifestyle Solutions can help you enjoy the retirement you have planned for.

31st July, 2018

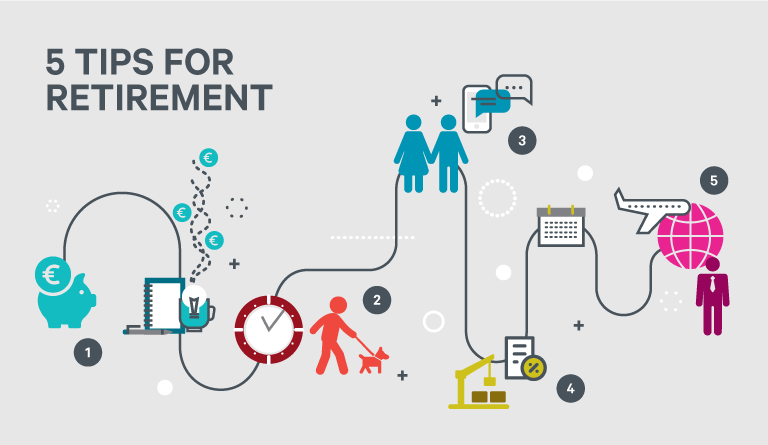

Retirement has changed over the years. It used to be pretty simple. You probably retired on your 65th birthday, someone paid you a nice steady pension, you played some golf and spoiled your grandchildren. Unfortunately, most people didn’t manage to live beyond 80. Dramatic improvements in life expectancy and living standards in Ireland have changed that. The great gift is that people now have on average another 10 to 15 years of life in pretty good health, but someone needs to pay for it. It can be a daunting experience, but for many people it’s a second chance to fulfil their dreams. In this article we set out some things to bear in mind.

Do the maths: The big unknown for most people approaching retirement is how financially secure they will be when they retire. A thorough financial health check can

feel like a terrifying exercise which many people procrastinate about. While we can’t guarantee the outcome will bring happiness to everyone, it should bring a greater

level of certainty. This greater certainty in turn allows better informed decisions to be made – e.g. not spending too much or too little, making the right choice with a ‘second chance’ career or deciding whether you can help the next generation get on the property ladder.

The problem for most people is that it’s difficult to assess complex pension options while taking tax, supplementary income sources and other assets into account. So ditch the DIY spreadsheet and get help from a qualified pension adviser.

Expect it to feel different: Retirement can bring fantastic opportunities and is often a day marked in calendars many years in advance. Equally, the transition for an executive is not always easy. When in the workforce, executives carry a lot of responsibility and influence. Their opinion is constantly sought, strategic direction depends on their decisions, and the phone never stops ringing. The reality is that the phone will stop ringing and someone else will step into their shoes. The realisation that no one is irreplaceable can sometimes be a shock to the system.

We recommend talking to colleagues or friends who have gone through the same experience in the run up to retirement. Ultimately you’re going to be happier if you embrace the change, accept that this feeling is normal and allow the new team to make their own decisions.

This should really go without saying but your retirement can impact your spouse and family just as much as it will impact you. In many Irish households, one spouse has taken the responsibility to manage the household and family. The sudden intrusion of the other spouse into this space isn’t always welcome! Many individuals also make great plans or bucket lists for when they retire. These plans aren’t usually as much fun on your own so it’s important to agree the list together at an early stage or you could join the expanding list of later life divorcees! It’s also worthwhile to create interests and activities as a couple or as a family, but also retain your individuality and your own separate interests.

The nature of retirement has changed and many aspects will become more fluid than in previous generations. That said, it’s a time to put some good foundations in place and the failure to make the right decisions can impact your life goals in time. One key step is to ensure your pension structures are as tax efficient as possible based on your own needs. For those with significant defined benefit pensions it’s worth reviewing the option, if available, of taking a transfer value before retirement, after which time the option is no longer available. It’s also a good time to review your Will and consider putting an Enduring Power of Attorney in place. If you have capacity, maybe set up small tax-efficient funds for the next generation, or take steps to ensure inheritance tax is limited. Finally when making an investment decision, it’s a good idea to make sure you understand the level of risk you are taking and find out about all the charges applying, such as exit penalties and lock-in periods.

The options are endless when you decide to retire from your primary career. Today many executives continue to leverage their vast experience. They can take on roles as mentors, consultants or impart wisdom as non-executive directors. Others take the opportunity to move in a completely new direction and set up a business or work in an area that has interested them their whole life. Some will give their time to charities, return to formal education or travel the world. Many still fancy the traditional family, golf course and grandchildren formula. As with most things in life, plenty of people will be happy to share their views on what you should do. There is no harm in listening, but ultimately you have to do what suits you and your family – whether you want to slow down or are just about to get going. After all retirement is just a word – you define it.

Download a PDF of our brochure outlining how Davy Lifestyle Solutions can help you enjoy the retirement you have planned for.

Warning:The information in this article does not purport to be financial advice and does not take into account the investment objectives, knowledge and experience or financial situation of any particular person. You should seek advice in the context of your own personal circumstances prior to making any financial or investment decision from your own adviser. The tax information contained in this article is based on Davy’s current understanding of the tax legislation in Ireland and the Revenue interpretation thereof. It is provided by way of general guidance only and is neither exhaustive nor definitive and is subject to change without notice. It is not a substitute for professional advice. You should consult your tax adviser about the rules that apply in your individual circumstances. Davy is not responsible for the interpretation of this information and any submissions made by you or a third party on your behalf thereon.

For over 90 years we have helped our clients to manage their wealth and realise their financial goals. Whether you would like us to professionally manage your portfolio or you would prefer to manage it yourself with advice, we can help. It all begins with a simple, no obligation conversation.

Email us at gavin.murray@davy.ie We'll get back to you as soon as possible

Contact us at +353-1-614-9044 Monday - Friday 9am to 5pm

Go to https://www.davy.ie/wealth-management For more information