Back to Market and Insights

Dr. Dorothy Maxwell FICRS

Head of Sustainability and ESG Advisory

Jonathan McKeown

Director of ESG

The Corporate Sustainability Reporting Directive (CSRD) and what it means for you

What is the CSRD?

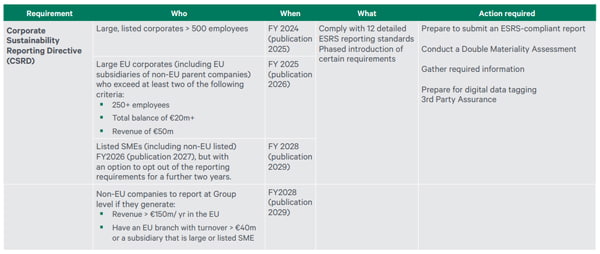

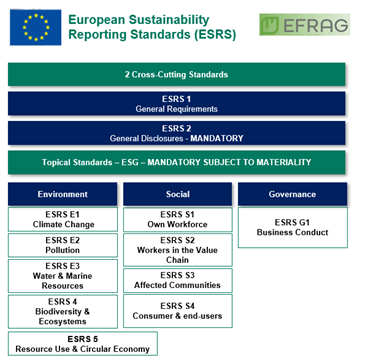

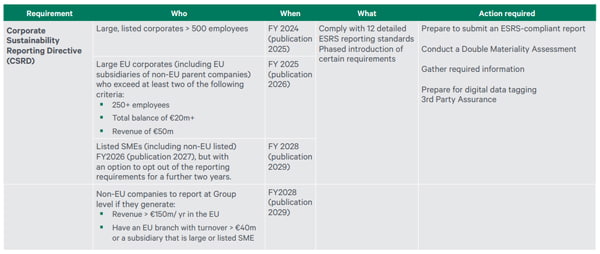

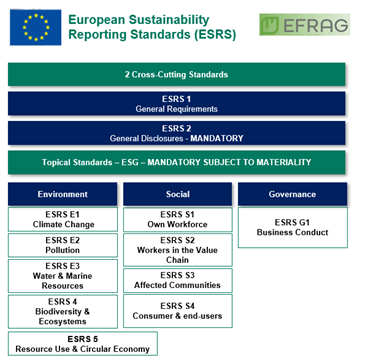

On 5th January 2023 the Corporate Sustainability Reporting Directive (CSRD) entered into force. This new directive modernises and strengthens rules about the social, environmental and governance information that companies must report on. New rules apply to the first batch of eligible companies from this year (financial year 2024), with reports to be published in 2025. Entities in scope for CSRD are required to comply with 12 detailed ESG reporting standards - the European Sustainability Reporting Standards (ESRS).

Sustainability Reporting changes under CSRD

CSRD brings a significant uplift in sustainability reporting for most businesses – even those already publishing annual sustainability reports. The 12 ESRS standards and EFRAG Double Materiality guidance provide the playbook to prepare for CSRD compliant reporting.

Source: Commission Delegated Regulation supplementing Directive 2013/34/EU as regards sustainability reporting standard csrd-delegated-act-2023-5303-annex-1_en.pdf (europa.eu)

Key requirements for CSRD reporting compliance include:

- Sustainability due diligence and double materiality (DM) are required as the basis for sustainability disclosures.

- Reporting aligned to the 12 x ESRS standards which cover cross-cutting and topic-specific ESG disclosure requirements. Sector-specific standards are also in development which will supplement these further.

- Sustainability due diligence requires companies to identify, assess, prevent, mitigate and remediate the actual and potential adverse impacts from its operations, products or services through its own activities and its business relationships (direct and indirect) across the value chain.

- Double Materiality (DM) requires disclosure on how the company’s activities affect or depend on the environment and people, as well as the company’s financial performance. This should consider short (current FY), medium (>5 years) and long-term (>10 years) time horizons.

- All legal ESG related requirements are mandatory to disclose under ESRS 2. One example is the EU Taxonomy.

- Other disclosures and datapoints in the ESRS topical standards cover ESG specific requirements for disclosures if they are material impacts, risks and opportunities over the short, medium and long term.

- Disclosure requirements in ESRS 2 and topical ESRS require reporting on governance, strategy, impact, risk and opportunity management, metrics and targets.

- A value chain focus is required where disclosure of sustainability information from upstream and downstream in the value chain aims to drive sustainable procurement and decarbonisation, potentially favouring those with available sustainability information.

- Mandatory verification and assurance starting as ‘limited’ assurance must be applied to CSRD disclosures, audited by independent and competent assurance service providers. This will transition to a requirement for “reasonable” assurance (a stronger, more demanding level) in due course. “Reasonable” assurance will require the use of sustainability assurance standards and practitioners who meet these competency requirements – current best practice includes ISO14064:3, ISO14065 and ISAE 3000.

How can Davy Horizons help you with CSRD reporting?

Davy Horizons can support by assessing your preparedness for these upcoming ESG Reporting requirements by:

- Undertaking a CSRD gap analysis and developing a checklist of actions to ensure that your company will be prepared for CSRD compliance.

- Undertaking the Double Materiality Assessment including the stakeholder engagement required by the CSRD. This will identify material impacts and associated financial risks and opportunities for your business.

- Development of a roadmap outlining key milestone actions for your organisation to meet the new mandatory requirements in the time required.

- Verify and assure ESG reporting data to meet the required sustainability assurance standards including ISO14064:3, ISO14065 and ISAE 3000.