Back to Market and Insights

Fiona Haughey

Associate Director, Financial Planning, Davy Private Clients

The cash conundrum | Is cash really king?

Pretty much everyone will need to keep cash for some reason. Whether its ensuring expenses can be met from income, or failing that knowing money is there to meet any cash shortfall now or in the future gives peace of mind. There are times though when more detailed discussions and advice are required on the topic. For example, a retiree who has received their pension lump sum and wants to discuss their options, a professional who has sold stock and is debating if repaying debt or investing the proceeds is best for them, or a successful business owner who is looking to optimise the accumulating cash in their business. In inflationary times, doing nothing could be your riskiest move. We offer a broad range of investment and liquidity solutions.

On the surface it may look risk free, but there are drawbacks to holding too much cash and for too long.

The benefits

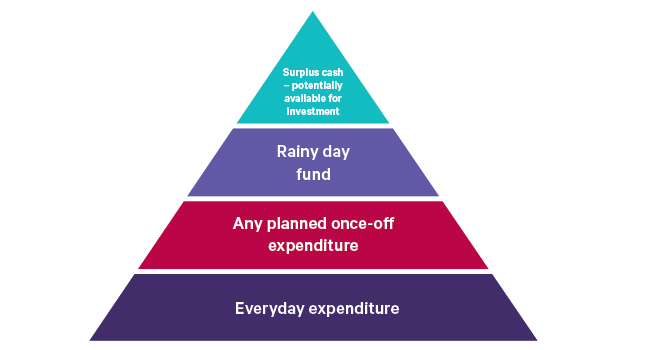

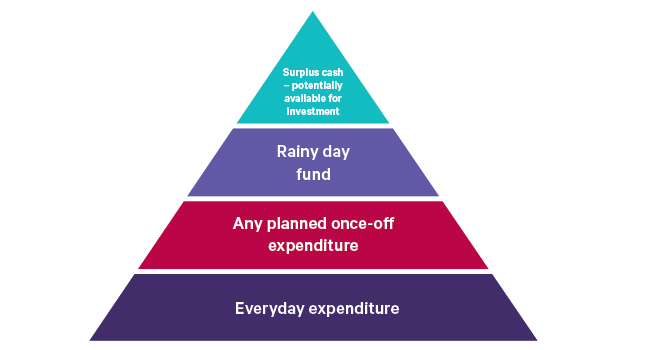

- Essential - if cash was on Maslow’s hierarchy of needs it would be at the bottom. A rule of thumb often cited is to hold 6 months expenses at a minimum in a rainy-day fund that is immediately accessible (couples need to ensure both partners have access to cash). This can be called upon when bad luck intervenes or for the more serious events (illness or injury). For retirees or those approaching retirement, we typically recommend holding at a least two times their annual lifestyle expenditure for additional comfort, particularly if they are now relying on their assets to meet ongoing expenses.

- Liquidity - Holding surplus cash can allow investors to take advantage of investment opportunities as they arise and can be necessary for liquidity purposes in a post-retirement pension to meet mandatory distributions.

The drawbacks

- Loss of purchasing power due to inflation. Holding too much cash in reserve comes with some drawbacks, however. Firstly, inflation risk. When the consumer price index (CPI) is above the interest rate on deposits, cash loses value in real terms. This has been particularly evident in recent years.

In nominal terms, cash in the bank may look like it is slowly increasing in value, but when factoring in the impact of inflation, the purchasing power of the funds may be going in the opposite direction.

We are often acutely aware of capital loss risk, the risk that your investment will lose some or all of its value. What we often fail to consider is inflation loss risk, the consequence of holding cash while the prices of everything in the economy increases. Irish inflation has run at 18% in the past three years1. This means that effectively, the saver that has left cash on deposit and earned nothing in return is left with a 18% loss in terms of purchasing power in under three years, having kept funds in what is generally seen to be a “safe” option.

- Low risk = low return. Unless cash is invested, it is not going to make you a return that comfortably keeps you ahead of inflation. Even in a “higher” interest rate environment, the largest Irish banks have been slow to pass on European Central Bank rate increases to deposit account rates.

- Opportunity cost of holding excess cash means that higher returns are often available in other asset classes. By not putting funds that are not needed in the short term to work in suitable investments, an opportunity to earn a return is forgone.

Cash certainly gives you options. However, we have viable options in liquidity solutions for the first time in more than a decade for money offering close to the European Central bank rate. Any decision around holding cash versus investing should incorporate your financial goals within a financial plan unique to your own circumstances. Cash can be a decent short-term solution for meeting short term expenses. For medium- and long-term goals we should look to more appropriately aligned solutions.

Figure 1: Cash needs

Source: Davy

1 Source: CSO CPI February 2021 to February 2024

See the full potential

In inflationary times, doing nothing could be your riskiest move.

Get in Touch

Warning: The information in this article is for illustrative purposes only and does not purport to be financial advice as it does not take into account the investment objectives, knowledge and experience or financial situation of any particular person. You should seek advice in the context of your own personal circumstances prior to making any financial or investment decision from your own adviser. There are risks associated with putting a financial life plan in place. There is no guarantee that by having a financial life plan in place, you will meet your objectives.