Back to Market and Insights

Paul Nicholson

Head of Investment Strategy

Stephen Grissing

Investment Strategist

Scott McElhinney

Investment Strategist

Conor Murtagh

Investment Associate

The Davy Digest - 24th February 2025

US equities moved sharply lower in the latter half of last week despite hitting all-time highs on Tuesday and Wednesday. Housing starts in the US fell sharply in January while the ISM services PMI came in weaker than expected. Walmart reported earnings on Thursday - guidance for the year ahead disappointed investors, prompting concerns about consumer spending. Minutes for the most recent Federal Reserve meeting were released, showing that Fed officials want to see more progress on inflation before cutting further. Officials noted tariffs and mass deportations of migrants as factors that could push inflation higher this year. In Europe, the flash consumer confidence indicator was released on Thursday showing that confidence improved in February. The German election took place yesterday, with prediction markets expecting a coalition involving the CDU /CSU. In the UK, inflation rose to a 10-month high of 3% in January. In Japan, GDP data showed that Japan's economy grew faster than expected in Q4, thanks to improved business spending and a surprise increase in consumption. Inflation in Japan rose to a 2-year high of 4%, boosting the Bank of Japan’s case for more interest rate hikes.

Last week's highlights

|

- Housing Starts (19/02) – Fell by 9.9% to 1.37m vs previous 1.52m.

- FOMC Minutes (19/02) - End of balance sheet reduction discussed.

- S&P Global PMI (21/02) - Growth in Manufacturing, vs a slowing Services number.

|

|

- Eurozone Consumer Confidence (20/02) – Strengthened to a 4-month high.

- Germany Manufacturing PMI (21/02) – Improved more than expected to 46.1.

- 2025 German Federal Election (23/02) - Likely a grand coalition, with debt brake reform high on agenda.

|

|

- UK Inflation (CPI) (19/02) – Rose to 3.0% year-on-year vs previous 2.5%.

- S&P Global Manufacturing PMI (21/02) – Unexpectedly dropped to 46.4 in February.

- Retail Sales (21/02) – Rose sharply to 1.7% YoY vs 0.3% forecast.

|

|

- Q4 Japan GDP (16/02) – Grew 0.7% quarter-on-quarter, ahead of expectations.

- Japan Inflation Rate (20/02) – Climbed to 2-year high of 4% vs 3.6% in December.

|

Looking ahead to this week, the release of inflation data (Core PCE) in the US will be the main event. Core PCE for January is expected to come in below December’s 2.8% figure, this would be a welcome sign for the Fed who need to see more progress on inflation before resuming the rate cutting cycle. Eurozone consumer confidence will be released on Thursday while retail sales and consumer confidence data are due out in Germany on Friday. Finally, in Asia, Tokyo CPI will be released on Thursday and the China NBS Manufacturing PMI will come out on Saturday.

What's on the radar

|

- Annualised GDP (Q4) (27/02)

- Core Personal Consumption Expenditures (28/02)

- Fed's Logan speech on QT

|

|

- Eurozone Consumer Confidence (27/02)

- Germany Consumer Price Index (28/02)

- Germany Retail Sales (28/02)

|

|

- BOE’s Dhingra speech (26/02)

|

|

- Tokyo Consumer Price Index (27/02)

- China NBS Manufacturing PMI (01/03)

|

Chart of the moment

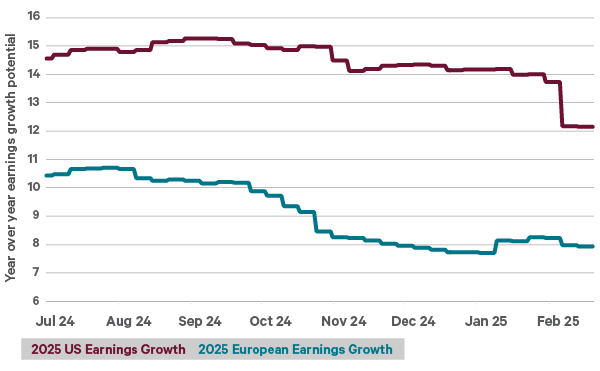

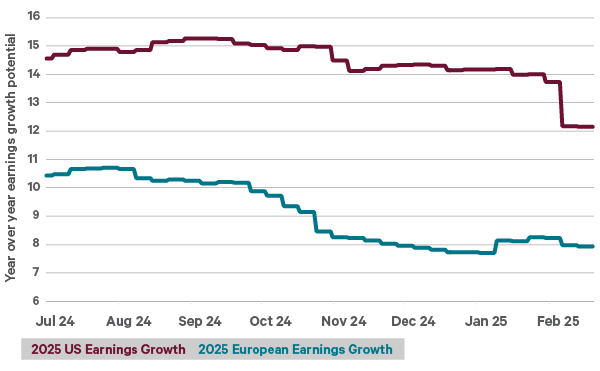

“The key to happiness is low expectations” – Charlie Munger

Source: DataStream as of 19/02/2025. Indices used: US - S&P 500, Europe - STOXX Europe 600

- Since the start of this year, earnings growth forecasts in the US for 2025 have been revised downwards, while European earnings forecasts have moved slightly higher.

- Coming into 2025, expectations were high for the S&P 500, with analysts expecting 14% earnings growth for 2025, that figure has now been reduced to 12%.

- European earnings forecasts have moved slightly higher this year due to a flurry of positive news stories concerning the war in Ukraine and early signs of economic recovery.

Warning: The information in this article is not a recommendation or investment research. It does not purport to be financial advice and does not take into account the investment objectives, knowledge and experience or financial situation of any particular person. There is no guarantee that by putting a financial or investment plan in place, you will meet your objectives. You should speak to your adviser, in the context of your own personal circumstances, prior to making any financial or investment decision.

Warning: Forecasts are not a reliable indicator of future performance.

Warning: Past performance is not a reliable guide to future performance. The value of your investment may go down as well as up.